Archives: Lessons

Lesson 8: Budget Approval Case Study

Lesson 7: KYGFIS Budget Help Guide

The KYGFIS Budget Help Guide is a tool that provides step-by-step instructions on how to complete a budget within the system. Please click on the below to review the Budget Guide, sample forms, and best practice tips for creating a budget. You should save these documents to your computer for future reference.

Lesson 6: Budget Adjustments and Renewals

Lesson 5: Budget Completion

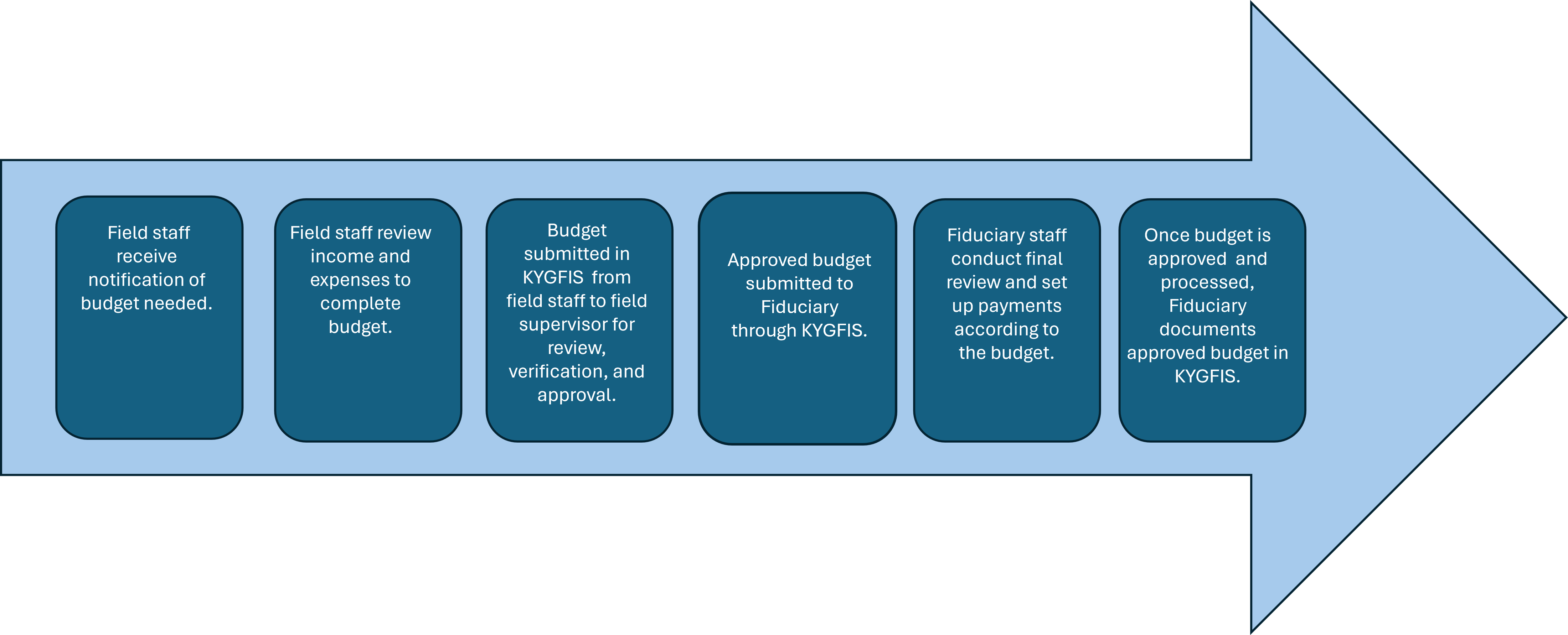

Budget Flow Process:

NOTE: Fiduciary staff have 3 business days after approval from the field supervisor and submission to review and audit the budget for accuracy before setting up payments, income accounts, and issuing final budget approval.

If a budget is not approved, the Fiduciary budget team will contact the Guardianship worker within 3 business days and request needed corrections or additional information, with a resubmission due date.

Lesson 4: When Budgets are Required

Budgets are required for individuals in the following levels of care:

The following levels of care do NOT require a budget. Payments are handled by Fiduciary staff.

Lesson 3: Budget Approval and Set-Up

Why Are Budgets Important?

Lesson 2: Welcome

Hello and welcome to this Fiduciary Training on Budget Approvals & Set-up. In this course, you will be working with Clair to review the budget requirements for Fiduciary staff working with individuals under guardianship. In this course, we will:

- Determine when budgets are required.

- Describe the budget process request flow.

- Identify requirements for submitting a budget for approval.

- Describe when budgets should be renewed or updated.

Lesson 1: Start Here – Contact Us

Select the accessibility widget on the right hand of the screen to access features such as:

Screen Reader: Reads content on the page.

Contrast Adjuster: Adjust color to meet your individual needs.

Text Magnifier: Adjust the size of text on the page to make reading easier.

And more!

Need Help?

Course Content

For help with course content reach out to Jennifer Rosenberg.

Technical Assistance

For help with HDI Learning and issues with the website, please use the “Contact Us” button.

SCCC 131: Senior Housing Options – Finding the Right Fit

Lesson

SCCC 131 Senior Housing Options – Location & Cost

SCCC 131 Senior Housing Options – Evaluating the Current Living Situation

SCCC 131: Senior Housing Options – Introduction

timeline

The Professional was the sole source and dispenser of knowledge and experties

Brain Break

“Before we move into the actual SOPs, let’s take a quick brain break to get our minds open and get ready to learn.”

Course Wrap Up

Course Evaluation

ECE 146: The Administration of the Hawaii Early Learning Profile (HELP) Birth – 3

Lesson 6: Conclusion

? Lesson 6: Purpose

The purposes of Lesson 6 are to:

- Introduce approximate Developmental Age Levels (DALs)

- Review resources for HELP® 0-3 System

Key Points to remember as we wrap up this course.

- HELP® is NOT a one-shot deal.

- Age ranges listed are NOT when the skill begins and ends.

- NOT all skills are pertinent for every assessment.

- Learning to use the HELP® is an ongoing process, that takes practice for mastery.

Lesson 5: Practice, Practice, Practice

? Lesson 5: Purpose

The purpose of this lesson is to give you opportunities to practice crediting using the HELP® (where a child “fits” in the Strand).

Use your Inside HELP® and Strands protocol to complete this Lesson. You must refer to crediting statements to accurately answer each question. Review the Credit Options and descriptions on p.i.21 of Inside HELP® or the inside cover of the Strands protocol.

Then view the video clips for Ryan, Logan, and Anna as indicated and answer the questions following each clip.